Take Control of Your Finances—One Week at a Time

Are you wondering, “how much do I need to save a week?” Stop guessing and start saving smarter with Weekly Savings Made Simple: Your Ultimate ‘How Much to Save Each Week’ Calculator Guide. This downloadable digital guide gives you the clarity and tools to confidently build weekly savings habits that actually stick. Whether you’re saving for a dream vacation, paying off debt, or planning for something bigger, this step-by-step resource will help you calculate and stay on track with your financial goals—without the overwhelm.

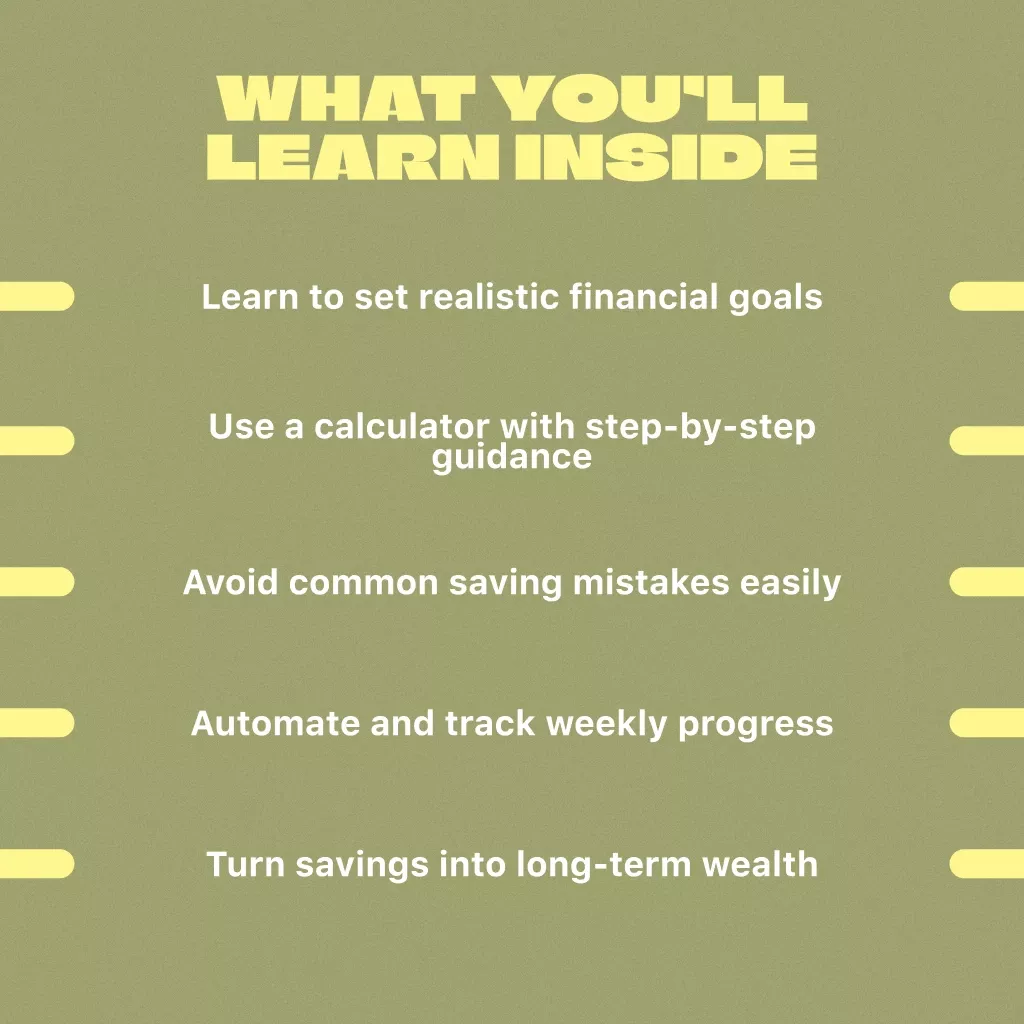

What’s Inside This Guide:

- Chapter 1: Why Calculate Weekly Savings? – Learn the psychological and financial benefits of weekly saving and how to define your goals clearly.

- Chapter 2: How to Use a ‘How Much to Save a Week’ Calculator – Discover what information you need, how to input it correctly, and follow a real-life example to see the system in action.

- Chapter 3: Common Mistakes and How to Avoid Them – Avoid common budgeting pitfalls like underestimating expenses or failing to plan for emergencies.

- Chapter 4: Taking It Further – Learn about automation, tracking, and how to grow your savings beyond the basics.

Why You’ll Love This Guide:

- Clear and beginner-friendly—perfect for anyone asking, “how much do I need to save a week?”

- Practical and actionable—step-by-step instructions paired with real examples

- Instant digital download—start using it immediately on any device

- Designed to fit real life—flexible for fluctuating incomes and changing goals

- More than just a calculator—this is a full guide that teaches you to think like a saver

Who Is This For?

This guide is ideal for students, families, freelancers, side hustlers, or anyone ready to take charge of their finances one week at a time. If you’ve searched for a reliable how much do I need to save a week calculator but want more than just numbers, this is your all-in-one resource.

Why This Guide Is Different

Unlike other tools that just give you a number, this guide walks you through the *why* and *how* behind it. With mindset tips, real-world examples, and future-focused strategies, it’s designed to turn your weekly savings into a long-term habit—and help you actually reach your goals.

Ready to Start Saving Smarter?

Download Weekly Savings Made Simple: Your Ultimate ‘How Much to Save Each Week’ Calculator Guide today and take the guesswork out of your budgeting. Whether you’re just getting started or need a reset, this guide is your path to consistent, stress-free saving. Your future self will thank you.

We are proud to offer international shipping services that currently operate in over 200 countries and islands world wide. Nothing means more to us than bringing our customers great value and service. We will continue to grow to meet the needs of all our customers, delivering a service beyond all expectation anywhere in the world.

How do you ship packages?

Packages from our warehouse in China will be shipped by ePacket or EMS depending on the weight and size of the product. Packages shipped from our US warehouse are shipped through USPS.

Do you ship worldwide?

Yes. We provide free shipping to over 200 countries around the world. However, there are some locations we are unable to ship to. If you happen to be located in one of those countries we will contact you.

What about customs?

We are not responsible for any custom fees once the items have shipped. By purchasing our products, you consent that one or more packages may be shipped to you and may get custom fees when they arrive to your country.

How long does shipping take?

Shipping time varies by location. These are our estimates:

| Location |

*Estimated Shipping Time |

| United States |

10-30 Business days |

| Canada, Europe |

10-30 Business days |

| Australia, New Zealand |

10-30 Business days |

| Central & South America |

15-30 Business days |

| Asia |

10-20 Business days |

| Africa |

15-45 Business days |

*This doesn’t include our 2-5 day processing time.

Do you provide tracking information?

Yes, you will receive an email once your order ships that contains your tracking information. If you haven’t received tracking info within 5 days, please contact us.

My tracking says “no information available at the moment”.

For some shipping companies, it takes 2-5 business days for the tracking information to update on the system. If your order was placed more than 5 business days ago and there is still no information on your tracking number, please contact us.

Will my items be sent in one package?

For logistical reasons, items in the same purchase will sometimes be sent in separate packages, even if you've specified combined shipping.

If you have any other questions, please contact us and we will do our best to help you out.

Order cancellation

All orders can be cancelled until they are shipped. If your order has been paid and you need to make a change or cancel an order, you must contact us within 12 hours. Once the packaging and shipping process has started, it can no longer be cancelled.

Refunds

Your satisfaction is our #1 priority. Therefore, you can request a refund or reshipment for ordered products if:

- If you did not receive the product within the guaranteed time( 45 days not including 2-5 day processing) you can request a refund or a reshipment.

- If you received the wrong item you can request a refund or a reshipment.

- If you do not want the product you’ve received you may request a refund but you must return the item at your expense and the item must be unused.

We do not issue the refund if:

- Your order did not arrive due to factors within your control (i.e. providing the wrong shipping address)

- Your order did not arrive due to exceptional circumstances outside the control of Kulivo (i.e. not cleared by customs, delayed by a natural disaster).

- Other exceptional circumstances outside the control of https://thehappysmiley.com

*You can submit refund requests within 15 days after the guaranteed period for delivery (45 days) has expired. You can do it by sending a message on Contact Us page

If you are approved for a refund, then your refund will be processed, and a credit will automatically be applied to your credit card or original method of payment, within 14 days.

Exchanges

If for any reason you would like to exchange your product, perhaps for a different size in clothing. You must contact us first and we will guide you through the steps.

Please do not send your purchase back to us unless we authorise you to do so.

Who knew a guide could make financial planning this engaging? The step-by-step process in chapter two was so easy to follow, even for someone like me who's never been good with numbers. And I really appreciate the emphasis on adjusting savings when goals change - it's such an overlooked aspect of budgeting.

Just finished chapter 1.2 and wow, setting clear financial goals has never been this easy! 🎯

I used to underestimate my expenses all the time, but thanks to chapter 3.1 that's history now! 😅 Still working on not overestimating my income though...

The calculator walkthrough was a breeze to follow! Saving for vacation here I come

This guide is like a gentle nudge towards better savings. Chapter 4 really got me thinking about automating my weekly savings.

The step-by-step walkthrough in chapter two was super helpful! I'm feeling confident about saving for our family vacation next summer ☀️🌴

I've got to say, the tips on avoiding common mistakes in Chapter three are spot-on! It made me realize how often I underestimate my expenses and ignore emergencies. While it was a bit confronting, it’s definitely helped me rethink my approach to saving

Chapter 1.3 had some fascinating insights into the psychology of saving - super intriguing!

Totally loved the real-life examples given in Chapter two - made it so much easier for me to understand how much I need to save each week!

Loving the practical advice in chapter four, especially on wealth building.

Chapter one had some great insights into why calculating weekly savings matters, really opened up my eyes 👀

Wish there were more tips on handling unexpected costs in chapter three... But overall, still a solid guide!